Accessing China's 3D Printing Market Through Industry Penetration and Customization

22 July 2014

Stratasys, a US-based business, is a 3D printer manufacturing company formed following the merger of Stratasys and Objet. A specialist in the development of 3D printing technology, the company has been the acknowledged market leader for several years. It has seen encouraging Asia Pacific sales and currently boasts a 41% market share in the region.

Speaking to HKTDC Research, Harry Wang, Stratasys' General Manager for Greater China, explained just how his company had made such impressive inroads into the China market.

China's 3D printing market: a late bloomer with rapid growth

Founded in the United States in 1987, Stratasys set up its first China office in 2006 in Shanghai. In 2011, it established Objet Shanghai as a dedicated division. Reflecting on those early days, Wang said: "Back then, it took us a long time to bring 3D printing technology to China. We had to consider how to penetrate different industries and just what 3D printing could do in China."

China, though, proved to be every bit the fast-growing market, Wang had anticipated. Stratasys' mainland client list has expanded dramatically over the last three years, as has its trade in both Hong Kong and Taiwan.

By way of a comparison, Wang said that, in the past, his company had mainly sold industrial equipment targeted at specialized users. Today, it offers a much broader range of equipment. This includes a variety of personal printers in a number of different models and grades, as well as more than 600 different varieties of 3D printing material.

By way of a comparison, Wang said that, in the past, his company had mainly sold industrial equipment targeted at specialized users. Today, it offers a much broader range of equipment. This includes a variety of personal printers in a number of different models and grades, as well as more than 600 different varieties of 3D printing material.

The majority of its customers in the China region are based on the mainland. In terms of Hong Kong, comparatively few companies use 3D printing technology for industrial design purposes, with some of the equipment purchased by Hong Kong customers only ever used on the mainland. In Taiwan, by contrast, the company's customers cover a broader spectrum, including production enterprises, design departments, as well as education and research institutes.

At present, supply and demand are growing in tandem in China's 3D printing market, presenting enormous growth prospects. Wang said: "The development of the industry is still at the exploration stage and has not yet had to contend with any kind of bottleneck."

Hong Kong as Asia-Pacific headquarters

Stratasys has established its regional headquarters for the Asia-Pacific region and Japan in Hong Kong. Wang believes the market in Hong Kong is relatively small and he has therefore treated Hong Kong as part of the wider China market. Explaining his thinking, he says: "It doesn't mean that the market in Hong Kong is not good. What Hong Kong offers, though, is services, and thus it is ideal as our headquarters in the Asia-Pacific region."

In terms of the China market, Stratasys' focus is on sales and marketing. None of the company's R&D centers or production bases are located in China. Its inkjet printing technology R&D center and production base are both in Israel. Its R&D center for FDM (Fused Deposition Modelling) technology as well as its R&D centers and production bases for personal printers and desktop printers are all located in the US. Its regional setup in China is only for the promotion of 3D printing technology and for the marketing of 3D printing equipment, while sales are mainly entrusted to agents of the respective channels.

Differentiating from competition

Stratasys is not the only global 3D printing giant that has expanded into China.

Comparing its marketing strategies to that of its competitors, Wang referred to 3D Systems and suggested  the two companies had very different approaches.

the two companies had very different approaches.

According to Wang, the strategies adopted by Stratasys and 3D Systems are quite distinct. While 3D Systems attaches greater importance to localisation in terms of communicating with the local market and introducing local products, Stratasys offers a one-stop service through its own pre-sale, after-sales and logistics companies.

In other differences, 3D Systems has no office in the Asia-Pacific region, whereas Stratasys has set up its regional headquarters Hong Kong, where it has a staff level of close to 100. Its Asia-Pacific warehouse is also located in Hong Kong, while it also maintains local companies or offices in Korea, Japan, Beijing and Shanghai. Stratasys has also set up local customer experience centres with their own field applications engineers in order to respond to customer needs.

Uncovering applications through industry penetration

Overall, Wang emphasized one key concept -- in terms of application, although 3D printing technology has attracted an increasing number of users, it is only through in-depth penetration into various industries that the value of 3D printing will ever truly be realized.

Expanding on his belief, Wang said: "We have, for example, a member of staff specifically assigned to the dental market. A medical practitioner with a relevant professional background, his role is to nurture the development of the 3D printing market in the dental service sector."

Following the robust developments of recent years, Wang believes 3D printing technology has already made its mark across all sectors in China, albeit to varying degrees.

This belief is reflected across Stratasys' sales targets. A wide range of consumables businesses, across both the electronics and non-electronics sectors, are one of the company's primary targets. Other priorities include high schools, scientific research institutes and any design organizations engaged in mechanical craft and artistic creativity. The company is also targeting automobile manufacturers, not only in terms of car assembly plants, but also auto parts suppliers. Aside from this, it is also looking at medical applications in the dental sector, as well as a series of complex applications within the construction industry.

This belief is reflected across Stratasys' sales targets. A wide range of consumables businesses, across both the electronics and non-electronics sectors, are one of the company's primary targets. Other priorities include high schools, scientific research institutes and any design organizations engaged in mechanical craft and artistic creativity. The company is also targeting automobile manufacturers, not only in terms of car assembly plants, but also auto parts suppliers. Aside from this, it is also looking at medical applications in the dental sector, as well as a series of complex applications within the construction industry.

Wang believes that it is only through industry penetration that 3D printing can continue to develop. He says: "Different industries have different requirements, and we need to communicate with the people from these various sectors."

Focus on stylish, personalized items

With rising expectations as to the potential of 3D printing, Chinese consumers are increasingly favoring products that are creative, personalized and fashionable. Their needs and preferences are ever-changing.

On the technical level, the 3D printing of certain products, such as eye-glasses, watches, mobile phones, earphones, footwear and clothing buttons, is fairly straightforward. At the same time, though, something of a new trend is emerging. Wang explains; "For example, a button turned out by 3D printing is no longer a product, but also represents a fashion element."

In light of this, customization is clearly another potentially huge market sector of 3D printing. Stratasys is well aware of this potential and expects the market to become further segmented.

Given this, the technology involved will soon face even greater challenges. In the case of an electronic product, for example, the degrees of hardness, precision, transparency, electrical conductivity and thermal resistance of the printing materials can all vary depending on the requirements of consumers.

According to Wang, the large-scale industrial production will continue to be carried out in the traditional manner and is not likely to be replaced by 3D printing technology. In the "made-to-order" market, however, there will be ever more small orders for personalized, customized items across numerous sectors.

Materials: a key factor in technological breakthrough

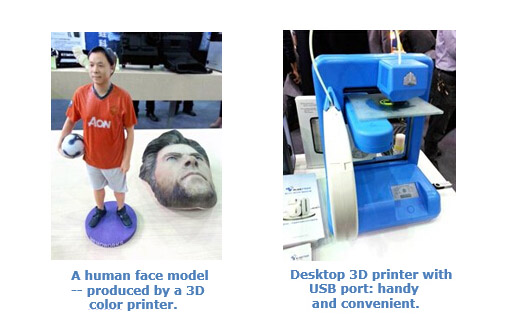

This year, Stratasys launched the world's first multi-material 3D industrial color printer - the Objet500 Connex3. The prototypes, moulds and parts produced by this printer are comparable to genuine production parts in terms of color, durabil ity, finish and mechanical properties. Wang regards this printer as a milestone for a "new era in the development of the 3D printing industry".

ity, finish and mechanical properties. Wang regards this printer as a milestone for a "new era in the development of the 3D printing industry".

He also believes that materials remain the core elements of 3D printing technology, saying: "The more diversified the materials are, the broader the range of applicable industries and the wider are their applications."

He says, for Stratasys, there is basically no pure technological upgrading in terms of 3D printing. While an equipment upgrade is not considered a major target, increased R&D efforts are being devoted to 3D printing materials, in line with market feedback. Wang says: "The company devotes 10% of its profits to R&D every year."

Convergence of 3D and traditional manufacturing

Despite this, Wang believes that there is some danger that the 3D printing industry has been over-hyped. He maintains that 3D printing will not replace traditional manufacturing and, instead, the two will develop jointly, complementing one another.

Wang's opinions are in contrast to a number of other industry players who have predicted that 3D printing will completely replace traditional manufacturing and usher in a third global industrial revolution.

Expanding on his own belief, Wang says: "Just as digital printing cannot replace traditional printing, I don't think that 3D printing can replace traditional manufacturing as they both have their advantages. In the future, 3D and traditional manufacturing will definitely come closer to each other, unleashing their true values through convergence."

Xiao Ying, Special Correspondent, Nanjing

Content provided by